Data plays a critical role in the insurance industry. It’s supplying insurers with the insight to make informed decisions and offer better products and services to their customers. But data on its own cannot fuel business transformation. It needs to be properly captured, maintained, scrubbed and stored. From this base, data can then be fed through advanced systems using artificial intelligence (AI) and machine learning (ML) to generate valuable insight. This helps cultivate data-driven knowledge. And that elevates decision-making processes.

There is a broad appetite among insurance holders for the fruits of this process: more engaging, relevant and personalized experiences. And they are open to sharing their own data to help insurers serve that up.

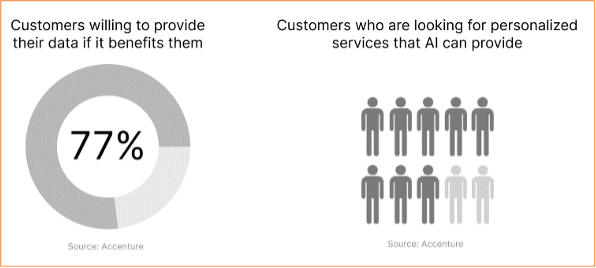

Among insurance holders, 77% are willing to provide their own data – as long as they can see the benefits, such as lower premiums, faster claims settlements and given coverage recommendations. In addition, 80% of insurance holders are actively looking for personalized services that artificial intelligence is capable of providing.

The desire is there. And so are the capabilities. But how exactly are AI and ML reshaping the rapidly evolving insurance industry? There are three areas: underwriting, claims processing, and product development. Let’s take a look at each of them.

Underwriting

Data is such a crucial component of underwriting. Insurance companies rely on data to assess the risk associated with insuring a particular individual or entity. This data includes an applicant’s information such as age, occupation, health and location. It also includes data on the type of property being insured. Once collected, insurers can then analyze this to determine the likelihood of a claim being made and set premiums.

One way that AI and ML are being used in underwriting is through the development of algorithms to analyze an applicant’s data, such as those metrics mentioned above. These algorithms can then use this data to predict the likelihood of a claim being made and determine the appropriate level of risk.

In addition to analyzing data about an applicant, AI and ML are also being used to analyze data about the type of property or liability being insured. For example, an ML system may be built to analyze data on the construction and maintenance of a building to predict events such as the likelihood of a fire.

Ultimately, leveraging AI and ML in underwriting can help insurance companies operate more efficiently and accurately assess risk, enabling them to offer more competitive premiums and better serve their customers. It can also help insurance companies identify and mitigate potential risks, such as by encouraging customers to implement certain safety measures or by declining to insure certain types of high-risk properties or activities.

Claims Processing

Data is also important in the claims process. Insurance companies use data to assess the validity of claims and determine the appropriate level of compensation. This can involve analyzing data on the cause of the loss, the scale of the damage, and any relevant policy limits.

One of the ways that AI and ML are being used in the claims process is through the development of algorithms that can analyze data related to a claim. These algorithms can then use this data to determine the likelihood of a claim being valid and determine the appropriate level of compensation.

They can also be used to identify patterns or trends in claims data that may indicate fraud. For example, an algorithm may identify patterns connected to suspicious activity, like a high number of claims being made by a single individual, or a cluster of claims being made in a particular geographic location. By identifying these patterns, insurance companies can more effectively detect and prevent fraudulent claims.

Thirdly, artificial intelligence and machine learning are being used to automate various aspects of the claims process. For example, an ML system can be developed to automatically review and approve certain types of claims. This can free up claims adjusters to focus on more complex or disputed claims.

Product Development

In addition to optimizing the underwriting process and claims handling, data is also important in the development of new insurance products and services. By analyzing data on customer needs and preferences, insurance companies can design products that better meet the needs of their customers.

By connecting AI and ML systems, insurers can analyze data on customer preferences, wants, and needs. This can help companies better design products that meet the needs of their customers. Data such as customer demographics and purchasing patterns can be analyzed to discover gaps in their products and services and identify new opportunities.

With artificial intelligence analyzing algorithms, insurers can personalize policies based on behavior. You can scale up from the individual level to the group level, putting specific customers into segments depending on certain characteristics. This helps in the development of targeted marketing campaigns that can boost customer engagement.

AI algorithms are also able to take customer feedback published online – whether it’s from forums or social media channels – and analyze that to better understand customer attitudes and sentiments towards an insurer and its products and services. This can be used to optimize existing offerings, closing the gap between them and their customers.

The bottom line: Data-driven insurance

Data will continue to play a crucial role in the insurance industry. It’s helping insurers make better decisions, improve their operations, and offer more effective and personalized products and services to their customers.

Are you looking to unlock growth for your financial services business through artificial intelligence or machine learning? Connect with us.

Interested in learning more about the technology trends shaping the future of insurance? Check out this industry webinar: From Data to Customer Experience – How Digitization is Shaping the Insurance Industry.